Think of ecommerce fraud prevention not as a technical chore, but as a core part of your business strategy. It’s what protects your revenue, your reputation, and the trust you've built with your customers. An online store without a solid plan is like leaving the cash register open and the doors unlocked overnight—it's an open invitation for trouble.

The Hidden Costs of Ecommerce Fraud

It’s easy to get excited looking at your sales reports and seeing that upward trend. But lurking just beneath the surface, ecommerce fraud can be a silent profit killer. The real hit isn't just the price tag on a stolen item; it's a domino effect of costs, both direct and indirect, that can seriously harm a business.

Every single fraudulent transaction sets off a painful chain reaction. You’re not just out the cost of the merchandise. You also get slapped with chargeback fees—penalties from payment processors that can run anywhere from $20 to $100 per incident. Those fees add up fast and eat away at your bottom line.

The Financial Ripple Effect

The direct financial hit goes much deeper than just the transaction value. Think about all the operational costs you sink into a bogus order: the time your team spent processing it, the packing materials used, and the money spent on shipping. All of that is just gone. These burdens are especially heavy in the fast-paced retail industry.

Fraud's impact isn't a one-time sting; it's a constant drain. It forces you to spend time and money on fighting disputes and beefing up security instead of focusing on what really matters: growing your business.

This financial drain is growing, and it's growing fast. Global losses from ecommerce fraud jumped from $41 billion in 2022 to $48 billion in 2023. Even more worrying, experts predict that number could skyrocket to $107 billion by 2029. It’s a clear sign that fraudsters are getting smarter and more aggressive.

Damage Beyond the Balance Sheet

The cost that hurts the most, though, is often the one you can't see on a spreadsheet: the loss of customer trust. When shoppers feel their personal information isn't safe with you, they won't come back. Period.

This loss of trust means you have to spend more to acquire new customers, and it tarnishes your brand's reputation—something that’s much harder to fix than a balance sheet. A proactive ecommerce fraud prevention plan isn't just a defense; it's an investment in the future and stability of everything you’ve worked so hard to build.

Getting Inside the Head of a Modern Ecommerce Fraudster

If you want to build a solid defense, you first need to understand how the other side thinks. Modern ecommerce fraud isn't just one type of attack; it's a whole toolkit of sneaky tactics designed to poke holes in the way we sell things online. Honestly, the first step to building a strong ecommerce fraud prevention strategy is to start thinking like a scammer.

These criminals aren't just randomly clicking buttons. They have clear goals, whether it’s to get their hands on expensive electronics, steal credit card numbers to sell on the dark web, or simply score a free product. Every move they make is calculated. Once you start recognizing their methods, you'll begin to see the tell-tale signs in your own data.

This is more important than ever, as fraud is constantly shifting to the path of least resistance. Card-not-present (CNP) fraud—the bread and butter of online scams—is on track to hit $28.1 billion in losses by 2026. Mobile shopping is a particularly big blind spot; it’s responsible for 33% of fraud costs in the US and a whopping 41% in Canada, even though it’s not the biggest slice of the sales pie. Scammers love the small screens and quick checkouts on phones because they make it easier for fraudulent activity to go unnoticed. You can dig deeper into these numbers in this detailed report on ecommerce fraud.

The Classic Heist: Chargeback and "Friendly" Fraud

Chargeback fraud is the one most people have heard of. It’s pretty straightforward: a criminal gets their hands on stolen credit card info and buys something from your store. You ship the product, and then the actual cardholder sees the charge, calls their bank, and boom—a chargeback reverses the payment. You’re left without the product and without the money.

But there’s a trickier, and frankly more frustrating, version called friendly fraud. The person committing it isn't some shadowy hacker; it's one of your actual customers. They buy a product, receive it, and then call their bank to claim it never arrived or that they didn't authorize the purchase. Their motive is simple: they want to keep the item and get their money back.

Friendly fraud feels like a betrayal because it comes from a seemingly legitimate customer. It blurs the line between a genuine service issue and intentional deception, making it incredibly difficult to dispute without ironclad proof of delivery and transaction validity.

This stuff really hurts. Not only are you out the product and the sale, but your payment processor slaps you with a chargeback fee. Rack up too many of those, and you could even lose your ability to process credit cards altogether.

When They Steal the Keys: Account Takeover Attacks

Picture a thief getting a copy of your customer’s house key, waltzing right in, and using their credit cards to go on a shopping spree. That’s pretty much what an Account Takeover (ATO) attack is in the digital world. Scammers use login details stolen from other website breaches to break into your customers' accounts on your site.

Once they're in, it's a goldmine. They can:

- Place huge orders using the saved credit cards on file.

- Scrape personal data like addresses and phone numbers to use for identity theft.

- Empty out loyalty points or gift card balances that your customer has saved up.

The scary part is that these orders often look legitimate to basic fraud filters because they come from a known customer account. This makes ATO one of the most damaging and difficult schemes to catch, causing a world of pain for your business and completely shattering your customer's trust.

More Deceptive Schemes to Watch For

The attacks don't stop there. Fraudsters have a whole bag of tricks they use to hit online businesses from different angles. Knowing what else is out there is critical for building a complete defense.

Here's a quick look at some of the other common schemes, who’s usually behind them, and how they can impact your business.

Common Ecommerce Fraud Types and Their Impact

| Fraud Type | Primary Attacker | Key Business Impact |

|---|---|---|

| Triangulation Fraud | Sophisticated Fraudsters | Lost inventory, chargeback fees, and severe brand damage from selling stolen goods through your store. |

| Return Fraud | Deceptive Customers | Financial loss from accepting used, damaged, or different items for a full refund ("wardrobing"). |

| Counterfeit Listings | Malicious Sellers (Marketplaces) | Erosion of customer trust, legal liability, and damage to your marketplace's reputation. |

| Fake Reviews | Competitors or Scammers | Misleading new customers, damaging your star ratings, and unfairly boosting competitor rankings. |

Each of these tactics targets a different weak point in the ecommerce journey, from the checkout process to customer service and even your brand's reputation. A good defense isn't about stopping just one type of attack; it's about building layers of security to catch these threats before they do any real, lasting harm.

Spotting the Early Warning Signs of Fraud

Knowing the types of fraud is a great start, but spotting an attack in real-time is a different skill entirely. It’s less about having a magic formula and more about being a good detective—looking for clues that just don't add up.

A single odd detail might be nothing. But when you see a few suspicious signals clustered around one transaction? That’s when your alarm bells should start ringing.

True ecommerce fraud prevention isn’t about being so cautious that you block legitimate customers. It's about learning to spot the patterns that scream "scam" so you can stop criminals before they do any damage. Every transaction leaves a trail of data, and your first line of defense is learning how to read it.

Mismatched Location Data

This is one of the oldest tricks in the book, and it's still one of the biggest red flags. If a customer’s location data is all over the map, you need to ask why.

Think of it like this: if someone in Romania is trying to place an order, but their credit card is registered to an address in Ohio, and they want the package shipped to a freight forwarder in Delaware... something’s off.

Keep an eye on these three key pieces of information:

- IP Address: Where is the order actually being placed from?

- Billing Address: What address is on file with the credit card company?

- Shipping Address: Where are the goods going?

Of course, there can be legitimate reasons for mismatches. People travel. They buy gifts for friends and family. But a messy combination of locations—especially when one is a known high-risk country—is a clear signal that the order needs a closer, manual look.

Unusual Order and Behavior Patterns

Here's the thing about fraudsters: they don't act like your real customers. They're usually in a rush, they aren't loyal to your brand, and they're trying to get as much as they can, as fast as they can. Their behavior is often a dead giveaway.

For instance, be wary of a brand-new customer who suddenly places a massive order for all your most expensive items. If they tack on a request for expedited overnight shipping, that’s an even bigger red flag. They want the goods in hand before the real cardholder gets a bank alert and shuts them down.

A genuine first-time buyer will probably start small to test the waters. A fraudster, on the other hand, goes all-in immediately because they’re playing with stolen money and working against the clock.

Other tell-tale behaviors include:

- Several orders placed to the same address but using different credit cards.

- A strange, sudden spike in orders from a specific city or region.

- A series of failed payment attempts followed by a successful one, which often means they're testing a list of stolen card numbers.

Payment Verification Failures

Your payment processor gives you some incredibly powerful, yet simple, tools to catch fraud right at the checkout. The two most important are the Address Verification System (AVS) and the Card Verification Value (CVV). You have to pay attention to what they tell you.

AVS simply checks if the billing address entered at checkout matches the address the bank has on file for that card. If it doesn't match, you get an "AVS Mismatch"—a strong sign that something is wrong.

The CVV is that little three- or four-digit code on the card. If a customer gets it wrong, it almost always means they don't have the physical card in their possession.

Sure, a single typo can cause a mismatch. But if you see multiple failures, or an AVS/CVV failure combined with other red flags we've discussed, that order is high-risk. These are automated systems screaming at you to pause and investigate before shipping anything out the door.

Building Your Ecommerce Fraud Prevention Toolkit

Recognizing the warning signs of a scam is the first step, but having the right technology in place is what truly empowers you to stop fraudsters in their tracks. Building a solid ecommerce fraud prevention toolkit isn't about finding a single magic bullet. Instead, you need to layer different types of tools—from simple, foundational checks to more advanced, intelligent systems—to create a defense that’s tough to break.

Think of it like securing your home. You start with the basics, like locking the doors and windows. In the world of ecommerce, this means activating the essential security features built into your payment processor. They're your first line of defense and can stop a surprisingly large number of clumsy fraud attempts before they ever become a problem.

Foundational Security Checks

The two most fundamental tools you have are the Address Verification System (AVS) and Card Verification Value (CVV) checks. They are simple, surprisingly effective, and should be considered non-negotiable for any online business.

- Address Verification System (AVS): This tool simply cross-references the numbers in the billing address a customer enters with the address the bank has on file. A mismatch is a pretty big red flag.

- Card Verification Value (CVV): This is the three- or four-digit security code on the card. A failed CVV check is a strong signal that the person placing the order doesn't actually have the physical card in their hand.

While these tools are great, they aren't perfect. They can sometimes flag legitimate customers who just made a typo, creating what we call "false positives." That’s why they work best as part of a larger, more thoughtful strategy, not as your only line of defense.

Strengthening Your Defenses with 3D Secure

To add another layer of security, especially for international or high-value sales, look into implementing 3D Secure protocols. You’ve probably seen these yourself under brand names like Verified by Visa or Mastercard SecureCode.

Think of 3D Secure as a digital bouncer at your checkout. It briefly redirects the customer to their bank's own site to complete an extra verification step, usually by entering a password or a one-time code sent to their phone.

This extra step is a game-changer because it shifts the liability for fraudulent chargebacks from you, the merchant, back to the card-issuing bank. It’s a powerful way to protect your revenue, though some businesses worry it adds a bit of friction to the checkout process.

The key is to use it strategically. Applying it to every single transaction might annoy some customers, but enabling it just for high-risk orders strikes an excellent balance between security and a smooth user experience.

The Power of Intelligent Fraud Prevention Platforms

While the tools above are crucial, they are mostly reactive. For businesses that want to get ahead of the game, intelligent fraud prevention platforms powered by machine learning are the answer. These systems don't just follow a static set of rules; they learn, adapt, and evolve over time.

Imagine a security guard who only looks for people wearing a specific red hat. That's a simple, rule-based system. A fraudster could easily get past them just by wearing a blue hat.

Now, imagine a seasoned security expert who can spot suspicious behavior—someone loitering, looking nervous, or checking entry points from a distance. That’s a machine learning model. It analyzes thousands of data points in real-time to spot the complex, subtle patterns that signal real fraud.

These advanced platforms look at everything:

- Behavioral analytics: How a user clicks, scrolls, and navigates your site.

- Device fingerprinting: Unique identifiers for a user's computer or phone.

- IP reputation: Whether an IP address has a history of fraudulent activity.

- Transaction history: The user's past purchase behavior on your site and others.

By connecting all these dots, AI-driven systems can assign a risk score to each transaction. This lets you automatically approve good orders and flag suspicious ones for a quick manual review, which means you block more fraud without accidentally declining legitimate customers.

While these systems are highly effective against transaction fraud, remember that brand protection is a separate but related challenge. If you are dealing with fake product listings, our guide on how to report counterfeit products provides specific steps for marketplaces.

Comparing Fraud Prevention Tools

Choosing the right technology depends on your business's specific needs, risk level, and budget. Here's a quick breakdown of the most common tools to help you decide where to start.

| Tool/Technology | How It Works | Best For | Potential Limitations |

|---|---|---|---|

| AVS/CVV Checks | Verifies billing address numbers and card security code with the issuing bank. | All businesses as a baseline security measure. It's a fundamental first step. | Can create false positives from typos; easily bypassed by sophisticated fraudsters. |

| 3D Secure | Adds a bank-level authentication step (e.g., password, SMS code) at checkout. | Merchants with high-value items or significant international sales. | Can add friction to the checkout process, potentially lowering conversion rates if overused. |

| Device Fingerprinting | Creates a unique ID for a user's device (browser, OS, etc.) to track it over time. | Identifying repeat fraudsters who use different cards or personal information. | Can be spoofed by advanced users; privacy regulations may impact data collection. |

| Machine Learning Platforms | Analyzes thousands of data points in real-time to calculate a transaction risk score. | Businesses needing proactive, adaptive protection against complex fraud patterns. | Can be more expensive; requires an initial learning period to become fully effective. |

Ultimately, the strongest defense is a layered one. Starting with the basics like AVS/CVV and strategically adding more advanced solutions like a machine learning platform will fortify your business against the ever-changing tactics of modern fraudsters.

Building a Proactive Fraud Prevention Strategy

Having a great set of tools is a good start, but a toolkit is only as good as the strategy behind it. A proactive ecommerce fraud prevention plan is about moving from simply reacting to attacks to getting ahead of them. This means really understanding where you’re vulnerable and creating a clear, repeatable process for your entire team to follow.

Think of it like a fire safety plan for your business. You don't just buy a fire extinguisher and hope for the best. You find the high-risk areas, install smoke detectors, and run drills so everyone knows what to do when an alarm goes off. The same idea applies here.

Start with a simple risk assessment. Dig into your own data. Where has fraud hit you before? Are there certain products that get targeted constantly? Do you see a spike in chargebacks from specific regions? Answering these questions is the first step to shoring up your defenses.

Nailing Down Your Manual Review Process

Even the smartest automated systems will occasionally flag a transaction that’s in a gray area. This is where a solid manual review process becomes your secret weapon. It’s the safety net that catches fraud your tools might miss while also saving legitimate orders that were accidentally flagged as suspicious.

Your manual review checklist should be quick and to the point. When an order gets flagged, have a team member check a few key things:

- Geolocational Sense: Do the IP address, billing address, and shipping address all line up? A customer in Miami shipping a package to Seattle is normal; a customer whose IP is in Romania but is shipping to Miami with a billing address in Seattle is a major red flag.

- Customer History: Is this a brand-new customer dropping $2,000 on their first purchase? Or is it a loyal customer with a long, consistent buying history? Context is everything.

- Contact Info: Does the email address look real, or is it just a keyboard smash like "hfkjdshf@email.com"? Give the phone number a quick search, too.

- Social Media Check: Can you find a real person on LinkedIn or Facebook that matches the name and email? It’s a simple check that can tell you a lot.

This hands-on check doesn’t have to be a huge time-sink. A quick five-minute investigation can be the difference between approving a great customer and losing product to a fraudster.

Turning Your Team into a Human Firewall

Your people are one of the most important layers in your defense. Train your customer service and fulfillment teams to recognize the red flags we’ve already discussed. They’re on the front lines every day and can often spot suspicious activity that software alone might completely overlook.

Make sure they have a clear escalation path. If an order just feels wrong, who do they go to? What are the exact steps for putting an order on hold? When everyone knows their role, your response becomes faster and much more effective.

A proactive strategy is built on the idea that fraud prevention is everyone’s responsibility. When your team is trained and empowered, they become a vigilant human firewall that complements your technology.

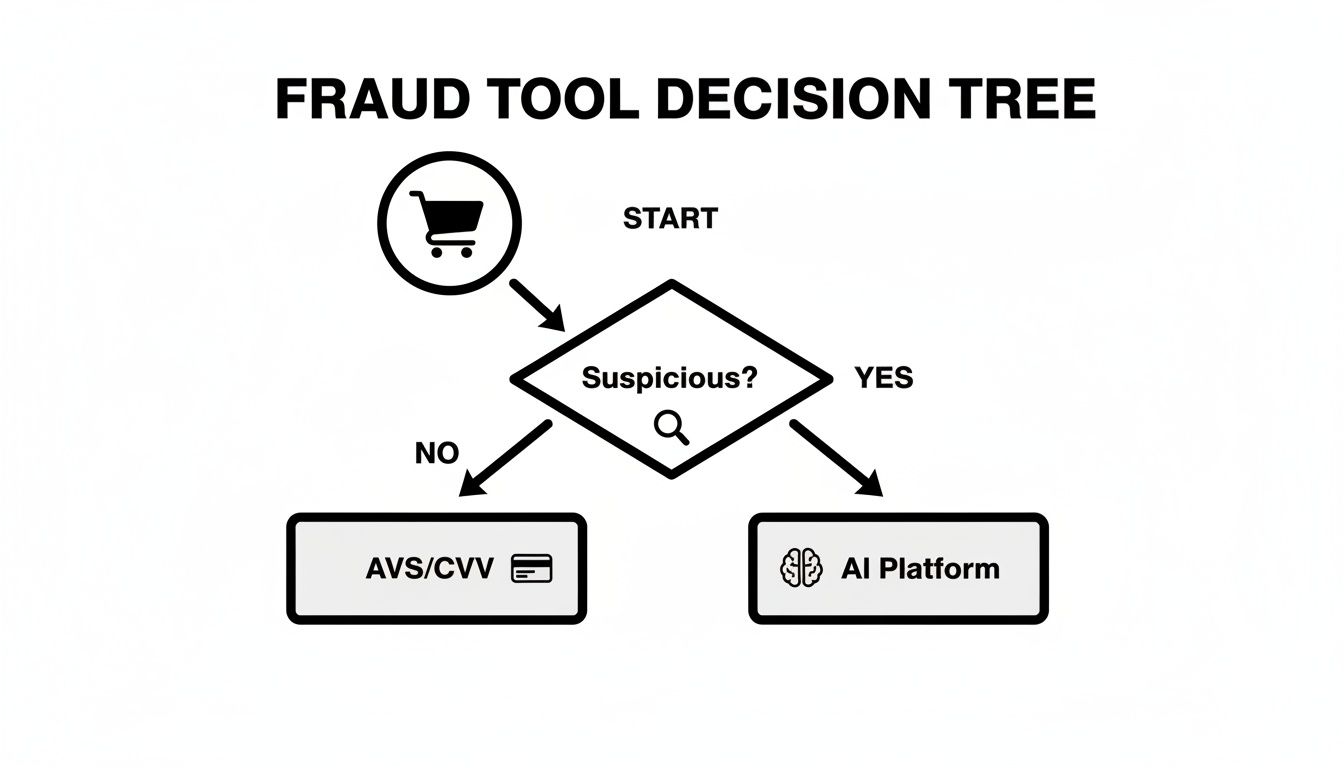

This decision tree gives a great visual of how a transaction should flow, from initial checks to a more detailed analysis for suspicious orders.

The big takeaway here is that a multi-layered approach is always best. You use simple tools for the obvious, low-risk orders and bring out the heavy hitters when things get suspicious.

Building a Defense in Layers

Relying on a single fraud prevention tool is a massive gamble. Sophisticated criminals know all the tricks to get around basic checks like AVS or CVV verification. The strongest ecommerce fraud prevention strategies create a "defense-in-depth" by layering multiple tools and processes on top of each other.

For a deeper dive into creating a comprehensive plan, this strategic guide to ecommerce fraud prevention offers some fantastic insights, especially if you're in a high-risk industry.

Here’s what your layers might look like in practice:

- The Foundation: Start with the basics. AVS and CVV checks should be enabled on every single transaction. No exceptions.

- The Authentication Step: Use 3D Secure strategically. It's perfect for high-value orders or purchases from international customers where the risk is naturally higher.

- The Intelligence Layer: Bring in an AI-driven platform that can score transactions in real-time and spot complex patterns that a human would never catch.

- The Human Gut Check: Have your trained team perform manual reviews on any order that gets flagged by the other layers.

Each layer is designed to catch what the previous one might have missed. By combining smart technology with clear internal procedures and an educated team, you build a resilient strategy that truly protects your revenue, your customers, and your brand's reputation.

Protecting Your Brand Beyond the Transaction

Real ecommerce fraud prevention is about more than just what happens at the checkout page. Yes, stopping bad transactions is critical, but a truly solid strategy has to protect your most valuable asset: your brand's reputation. Scammers aren't just after your money; they want to steal the trust your customers have in you.

This bigger picture involves threats that won't set off a single transaction alert but can cause serious, lasting damage. These attacks are designed to chip away at the confidence you’ve worked so hard to build.

The New Battlegrounds for Brand Integrity

Your brand is constantly being tested on multiple fronts. These attacks are often sneakier than a stolen credit card, but they can be just as devastating to your business. They cheapen your products, fool your customers, and drag your name through the mud.

Here are some of the most common brand-focused attacks you’ll see:

- Counterfeit Listings: Scammers will create fake listings for your products on marketplaces like Amazon or eBay. They'll steal your official photos and descriptions to sell cheap, shoddy knockoffs.

- Fake Reviews: Bad actors, sometimes even shady competitors, can bombard your product pages or business profiles with fake negative reviews to scare off potential buyers.

- Brand Impersonation: Fraudsters create fake social media accounts or entire websites that look just like yours. Their goal? Phishing for customer data or running ad scams using your good name.

Every one of these tactics poisons the well of customer trust. Think about it: a customer who buys a counterfeit doesn't just blame the scammer. They lose faith in your brand, assuming you have terrible quality control.

Protecting your brand isn't a one-and-done task; it's a constant effort. It means actively watching your online presence to find and shut down threats that are exploiting your reputation for their own gain. This is a core part of modern ecommerce fraud prevention.

Taking Action to Safeguard Your Reputation

Protecting your brand demands a proactive approach. You can't just wait around for a customer to report a fake profile or a counterfeit seller. By that point, the damage is already done. A strong defense means actively hunting down and removing these threats before they can take root.

The first step is knowing where to look. You need to be regularly searching for your brand and product names on major marketplaces and social media platforms. You can even set up alerts to get notified when new mentions or listings pop up. When you find something, you have to act decisively.

Effective enforcement means using the official channels each platform provides. Marketplaces and social networks have specific rules against counterfeiting, impersonation, and review manipulation. Get familiar with those policies and be ready to file detailed takedown requests. This usually means gathering evidence—like screenshots and links—and clearly explaining how the content is breaking the rules. For a deeper dive, you can explore detailed strategies for online brand protection to build out a more robust plan.

At the end of the day, protecting your brand is every bit as important as protecting your transactions. It ensures that when customers look for you, they find the real deal—an authentic, trustworthy business that deserves their loyalty.

Got Questions About Ecommerce Fraud? We've Got Answers.

When you're trying to protect your business from online fraud, it’s easy to feel a bit overwhelmed. Let's clear up some of the most common questions that pop up for business owners just starting out.

What's the Very First Thing I Should Do to Cut Down on Fraud?

Start with the tools you already have. The single most important first step is to turn on the basic security features your payment processor provides. Specifically, make sure you've enabled both the Address Verification System (AVS) and Card Verification Value (CVV) checks for every single transaction.

Think of these as the first line of defense at your digital storefront. They instantly check the customer's info against what their bank has on file, stopping a surprising number of basic fraud attempts cold. It's a simple flick of a switch that can save you a world of hurt.

How Do I Deal With "Friendly Fraud" on a Real Order?

When a customer disputes a legitimate charge, winning the fight comes down to one thing: proof. Your best weapon against this kind of "friendly fraud" is a solid paper trail.

For every order, you need to be religious about keeping records. This means you should save:

- Every email, from order confirmations to customer service chats.

- Shipping details, especially the tracking number.

- Proof that the package actually arrived, like a delivery confirmation from the carrier.

The moment you get a chargeback notification, don't wait. Package all this evidence up and send it to your payment processor right away. A fast, well-documented response is your best shot at getting your money back.

When it comes to friendly fraud, the bank automatically sides with the customer. It's on you to prove the transaction was legitimate, so the more detailed your records, the better.

Aren't Fraud Prevention Tools Super Expensive for a Small Business?

Not anymore. While there are certainly enterprise-level systems with hefty price tags, strong fraud protection is well within reach for small businesses. In fact, you might already have some powerful tools at your disposal. Many ecommerce platforms and payment gateways build solid fraud filters right into their service, often at no extra charge.

If you need a bit more muscle, plenty of third-party services offer plans that scale with your sales volume. It helps to think of it as an investment rather than an expense. The cost of a good tool is almost always a fraction of what you'd lose to a single big fraudulent order and the headache of the resulting chargeback fees.